Nearly 160 years after it was drawn up by the Bordeaux Brokers Union,

the 1855 Bordeaux Classification still defines the way we think about and refer

to the Left Bank wines of Bordeaux. It was produced by the Brokers at the

request of the Bordeaux Chamber of Commerce, intended for use as part of the

regional display at the Paris Universal Exhibition of 1855. The Brokers

returned their classification just two weeks after the original request was

made. It was based wholly on price, and included only the major estates of the

Left Bank.

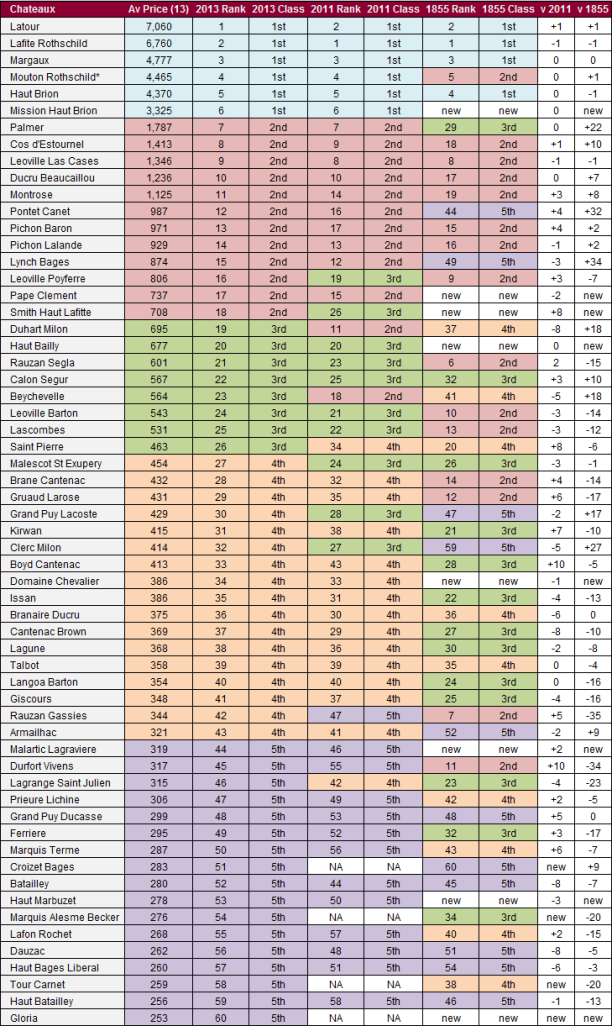

Four years ago Liv-ex decided to recreate the 1855 classification,

ranking major Left Bank wines in terms of their price. In 2011 we updated our

classification to reflect the market, and now that the market has shifted again

we have once again recreated the classification to reflect trading conditions.

Criteria and calculation:

To qualify for the Liv-ex Bordeaux Classification, wines had to be from

the Left Bank (including Pessac-Leognan) and be produced in quantities of more

than 2,000 cases. Only the first wine of each estate was considered. We

then calculated the average case price for every qualifying wine (lowest

available wholesale price for an in-bond owc 12x75cl case in good condition,

excluding duty and sales tax) for the past five vintages, 2007-2011. Prices are

in GBP and as of 28 February 2013.

As the brokers did in 1855 (and we did previously in 2009 and 2011) we

then split up the wines according to price band, which for 2013 are as follows:

- 1st Growths: £2,600 a case and above

- 2nd Growths: £700 to £2,599

- 3rd Growths: £450 to £699

- 4th Growths: £320 to £449

- 5th Growths: £250 to £319

These price bands were modified from those used in 2011. We calculated

the average price difference between the 2011 and 2013 studies for each level

of the classification, and then applied this difference to the previous price

bands. While the Third, Fourth and Fifth Growths all moved up by around 15%, the

price band for Second Growths remained the same and the price band for First Growths

dropped by 19%.

It remains a matter of academic debate whether the wines were listed in

their respective classes in order of price/quality – though the evidence seems

to point to this being so. We have assumed they were for the purposes of this

analysis.

Download the 2013 Liv-ex Bordeaux Classification

* Mouton Rothschild was elevated to First Growth status in 1973

2013 highlights:

Latour has taken the place of top Left Bank wine this

year: a position it held in 2009 but surrendered to Lafite in 2011. Mission

Haut Brion remains a First Growth, while Leoville Poyferre and Smith Haut

Lafitte have climbed from Third Growth status to Second Growth. Duhart Milon

and Beychevelle – wines that have a strong following in China – have dropped

from Second to Third Growth status.

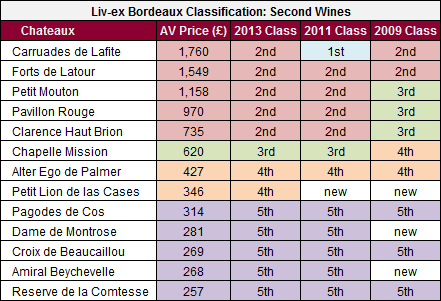

The Second

Wines: If the second wines from the great estates were

included, where would they rank?

If we include the second wines, which didn’t exist in 1855,

13 would be included in this year’s classification. This is the first time that

Petit Lion de las Cases has featured on the table: it was first introduced as

the second wine of Chateau Leoville Las Cases in 2007. Carruades de Lafite has

dropped from a First Growth to a Second, and Petit Mouton and Pavillon Rouge

have switched places: back in 2011 the

latter wine had a higher average price. The only other change is that Reserve

de la Comtesse has fallen to the bottom of the table – in 2011 it was the 9th

most expensive of the second wines.

Right

Bank

The 1855 Classification did not include any wines from

the Right Bank. We looked at the main Liv-ex Right Bank indices – the Right

Bank 50 and the Right Bank 100 – to see where their components would have been

placed. In this year’s classification, all of the wines in the Right Bank 50 (Ausone,

Cheval Blanc, Lafleur, Le Pin and Petrus) are classed as First Growths, and all

of those in the Right Bank 100 (Angelus, Clos Fourtet, Conseillante, Eglise Clinet,

Evangile, Figeac, Fleur Petrus, Pavie, Troplong Mondot and Vieux Chateau Certan)

are Second Growths. Of the latter group, Pavie is at the most expensive end of

the spectrum with an average price of £2,002, while Troplong Mondot is the

cheapest, at £756.

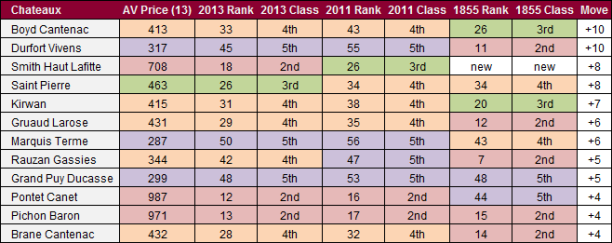

Climbers

The table below shows the biggest climbers when comparing

the 2011 and 2013 classification. Many have seen their value boosted thanks to

impressive 2009 and 2010 vintages.