Understanding liquidity is just as important to investors in fine wine as it is to investors in financial markets. In equity markets, liquid investments often trade at valuation premiums to illiquid investments. Similarly, the more liquid an investment in fine wine, the easier it is for an investor to build or exit a position quickly with less risk and lower cost.

As with other investments, a variety of different metrics can be used to measure liquidity. Liv-ex has decided to focus on one of the simplest – traded value – which provides a good indication of how much of an asset can be converted into cash within a given time period.

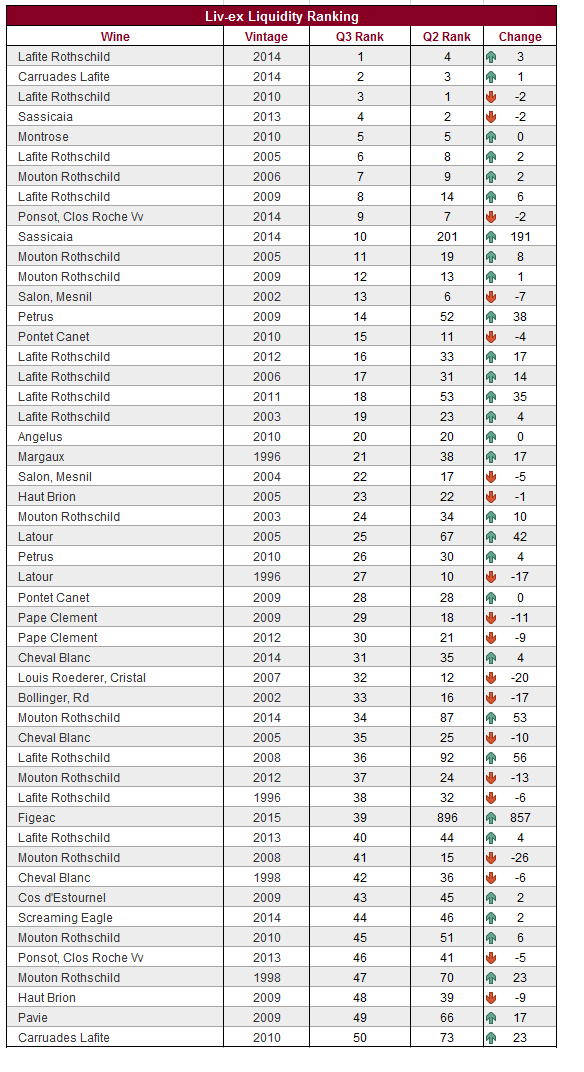

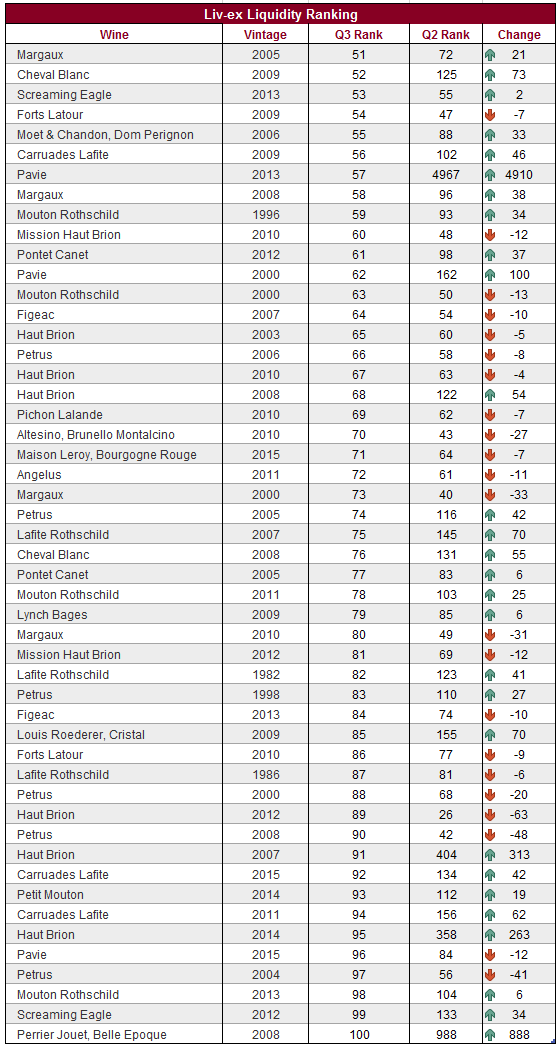

Liv-ex will be updating this ranking quarterly, to help track what is moving in the market.

Methodology

The ranking is based on a 12-month moving average of trade values. For instance, the ranking of Lafite 2014 for Q3 2017 is based on an average of the total traded value of the wine between the end of September 2016 and the start of October 2017. Once the averages have been calculated, the wines are then ranked in descending order from largest to smallest.

Limitations

Traded value is not a perfect measure of liquidity as it is biased towards wines with a high value per case, that might have otherwise been considered ‘illiquid’ if measured by another metric. However, as Liv-ex’s liquidity rank is merely gauging the amount regularly turned into cash on the Exchange, this bias to high value wines is mitigated.

It should also be noted the liquidity for any given wine captured in the ranking is descriptive not prescriptive. The nature of the wine market means that large deals occur sporadically, and at the right price most wines can be sold in volume with ease. This is another reason why an average is used, to smooth out any unusual monthly differences that might have occurred from large, infrequent transactions.

Trends

The composition of the ranking reflects the importance of certain wines within the secondary market. 42% of the table is comprised of First Growths, 14 of which are vintages of Lafite Rothschild. Not only that, but 11 of these vintages have moved up the Liquidity rank in past three months, reflecting a greater value of these wines traded within Q3.

Another recent trend has been the increasing liquidity of wines that have recently become physical from the 2014 vintage. Haut Brion 2014 has jumped 358 places in the last quarter. Nor has this been limited to Bordeaux wines alone. Sassicaia 2014, which gained 191 places.

The presence of three wines traded under SEP contracts within the table, Figeac, Carruades Lafite and Pavie, all from the 2015 vintage, demonstrates that there can be a robust market for trading En Primeur contracts. This is even with barriers to trade such as the requirement of having a bank guarantee.

Ranking

[mc4wp_form id=”18204″]