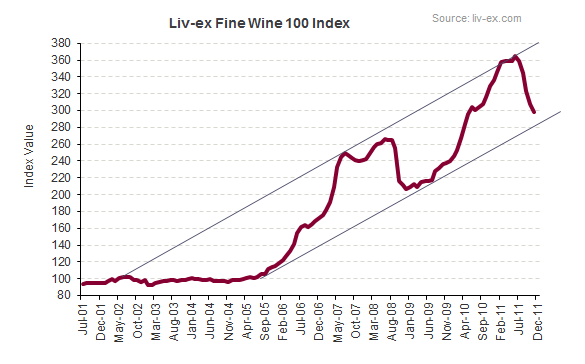

Unabated First Growth price falls saw the Liv-ex Fine Wine 100 Index lose 3.27 per cent last month, bringing its peak-to-trough fall to 18.3 per cent. Despite these losses, it's not all bad news. A technical analysis of the index's long-term movement suggests that the overall trend remains bullish.

The chart below shows the index's progress since its inception in July 2001, along with support and resistance trend lines*. Following a period of rapid growth, the index bounced off the resistance line in late 2007 and then approached it again in 2008 before declining for several months. The market recovered and the bulls charged once more in 2009, with the index finally breaking through its pre-crisis high in early 2010. In mid 2011, however, the benchmark reached the resistance line once more and bounced off twice before retreating.

Last month we edged another step closer to the the support line – typically used by traders to identify buying opportunities. This trend line has provided robust support in 2009. Will it hold in 2011/12?

*A support trend line identifies the level at which prices will be supported, should the existing trend hold. Resistance trend lines, by contrast, identify the level at which prices are more likely to fall, or experience resistance to growth.