Since January, First Growth prices have stabilised and the Liv-ex Fine Wine 50 Index has risen three per cent. But what of Lafite Rothschild—the former market leader that drove prices lower in 2011?

Riding the bulls

After producing a series of high-quality wines, Lafite began to outpace the other First Growths in 2006. Surging demand from Asia accelerated Lafite’s run in 2007 and the label rapidly became a “super brand”.

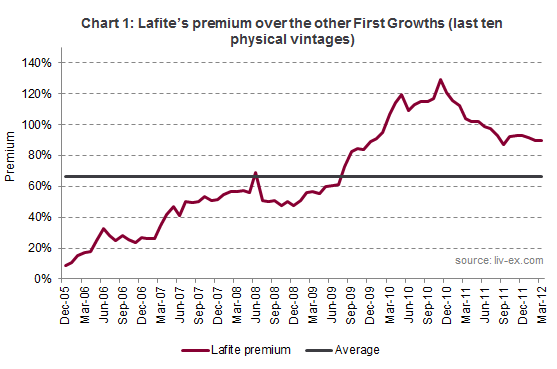

Chart 1 shows Lafite’s premium over its fellow Firsts from December 2005 onwards. On average, the ten most recent physical vintages of Lafite were just eight per cent more expensive in December 2005. By November 2010, however, insatiable demand had pushed its premium to 129 per cent.

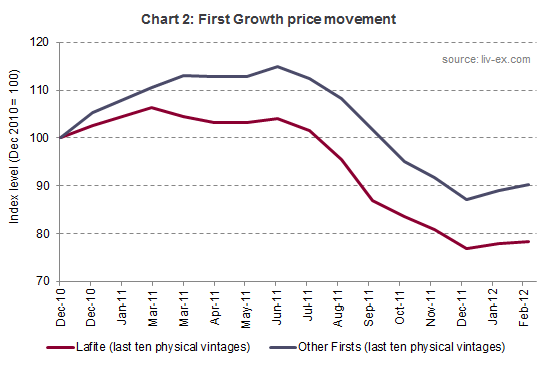

At this price level, the market began to question Lafite’s ability to sustain value. Buyers turned to its First Growth siblings and Lafite’s relative value declined. As you can see in Chart 2, Lafite barely moved in the first half of 2011, whereas the rest of the First Growths continued to rise.

A long-term view

Lafite’s premium in the period leading up to December 2010 seemed to be a measure of Asian confidence. When the market fell in 2008/9, the brand’s relative value fell with it. But as sentiment improved and interest in big-ticket wines increased, the price gap between Lafite and the rest of the Firsts widened.

In the last 12 months, however, the landscape has changed. Asian demand has broadened to include a larger group of chateaux and Lafite has gradually released its grip on the market. This said, the brand has seen a modest uptick in prices since the beginning of the year (along with the other First Growths).

All the evidence tells us that the base demand for Lafite has its core in China. Its recent price growth therefore points to increasing demand from the region—a trend, were it to continue, that would be welcomed by the broader market.

In absolute terms, Lafite will likely continue to appreciate in value. However, there is no reason to believe that its premium will ever regain its November 2010 peak of 129 per cent.

Just eight years ago, the ratio of Lafite to the other Firsts was 1:1. It is possible, then, that Lafite’s future price growth will be significantly slower than that of the other Firsts until they are trading at a similar price level. Lafite’s star will not fade overnight, but this may be the beginning of a sustained period of underperformance.