Today, the Financial Times published a report on the valuation methodology of the

Nobles Crus fund, managed by Elite Advisers.

As part of the research for the article, Liv-ex was asked to value the fund’s larger

holdings of Bordeaux wines, which together account for around a third of the total

assets.

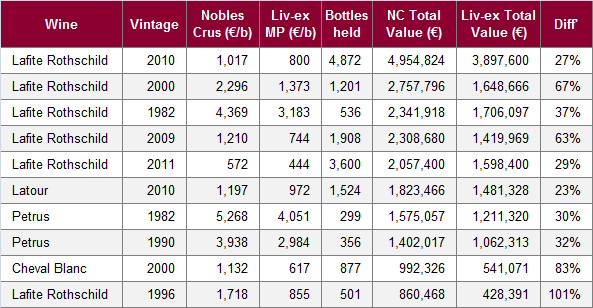

As highlighted in the table below, which details the top 10

Bordeaux holdings, our valuation differs significantly from that of Nobles

Crus. In total, we valued the top 50 holdings at €26m, as opposed to the €36m stated

by the fund itself. Nobles Crus' valution is 38% higher. .

All values as of 31

August 2012. The "Diff" is the premium of the Nobles Crus valuation over the Liv-ex Mid Price.

Noble Crus performed their valuations, according to the FT,

by taking “the average of two prices from auction houses, without removing

commissions, and two from wine merchants.”

The Liv-ex Mid

Price is based on actual Bid, Offer and transaction prices on the Liv-ex

Fine Wine Exchange (i.e. the price merchants are trading the wine at in B2B

transactions). We believe it is the most accurate price available in the

market.

Wine fund valuation is a subject we tackled as far back as

2009 in one of our monthly market reports (download).

What we wrote then still holds true today:

“With investors in general asking for ever-greater standards of

transparency and accountability – understandably, given recent events in the

financial world – it is important, even crucial, that the wine fund sector

meets these standards. The adoption of a common and transparent valuation

methodology would be one positive move – enabling investors to better choose

between the different options available and to accurately compare their

performance. Of course, in a relatively illiquid market an exact valuation is

always difficult. But with the Liv-ex Mid Price, we feel we have the created

the best fully independent measure of real market value.”

Although

the Liv-ex Mid Price (as used by many of the major UK wine funds) is provided

to professionals only, accurate market data for thousands of wine is made

available to collectors at Cellar

Watch. (For more on the data available see

here.) Basic packages are free.