Since Brexit, Sterling weakness has offered an incentive for Dollar and Euro-based buyers to purchase the stronger brands and a number of higher value wines have traded at fresh highs. In August, this trend has continued and eight Petrus vintages have traded at all-time highs.

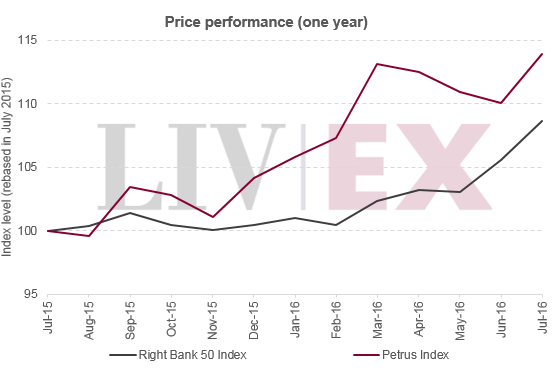

Petrus has performed well on the secondary market since fine wine started to rally at the end of last year. The wine’s index – tracking the last ten physical vintages – is up 12.7%, while its parent index, the Right Bank 50 is up 8.6% since November 2015. In August, it has been the lower scored and lower priced vintages that mostly traded at fresh highs. The 2011 vintage increased 8% from June to trade at £15,562 per 12×75 this month.

POP* analysis – Liv-ex’s loose measure of value, where a lower score suggests better value for money – shows that on a POP basis some of the higher scored Petrus vintages also offer relative value. The 97-point 2008 is currently available at a Market Price of £18,000 and carries the lowest POP score (24% below the average). The 96+ point 2012 also offers value and has the third lowest POP score of the recent physical vintages shown in the table below.

The 100-point 2009 and 2010 vintages also offer relative value. The 2010 has the fifth lowest POP score. It is currently available at just a 2% premium to the 97+ point 2005 and is being offered at a 31% discount to the 100-point 2000 vintage. Petrus 2010 traded at £24,400 on the Exchange this month, below its peak trade price of £26,204 in July 2011.

*A wine’s POP score is its price-over-points ratio, our loose measure of value. It is calculated by dividing the price of a nine-litre case of wine by a shortened 20-point score (scores from The Wine Advocate). We have calculated this 20-point score by simply subtracting 80 from the official rating (for barrel-score spreads we use the mid-point of the score), on the basis that any wine under 80 points is unlikely to attract a secondary market. In theory, the lower the POP score the better value a wine is.

[mc4wp_form id=”18204″]