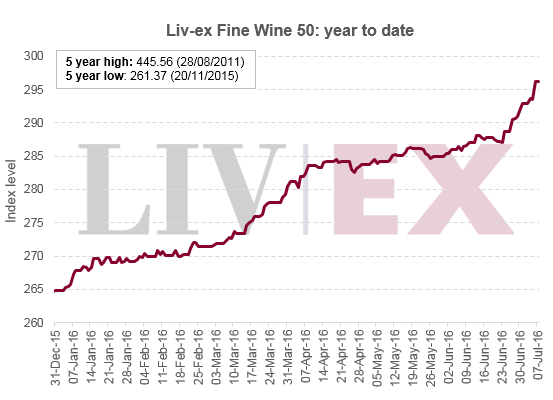

Trade was up by value and volume this week with the Fine Wine 50 Index maintaining a strong momentum. The index is now at its highest level since December 2013. Sterling hit a fresh 31-year low against the dollar driving more dollar-based buyers onto the bid, particularly from Asia.

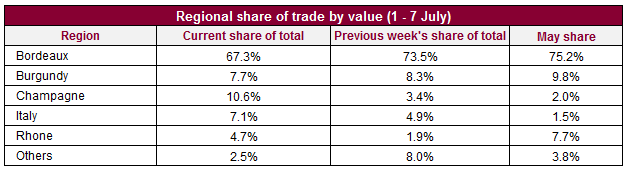

Bordeaux’s trade share slipped slightly this week. The First Growths represented just 20.6% of total activity. Mouton Rothschild was the most active at 27% and Lafite Rothschild was second at 23% of the First Growth’s share. Latour 2001 (WA 95) was the fifth most active wine traded by value.

It was a strong week for Champagne with the region representing 10.6% of activity by value. Bollinger Grand Annee 2005, Moet & Chandon Dom Perignon 2004 and Delamotte Blanc De Blancs NV all found the bid this week. Italy also saw activity increase, boosted by trade for Sassicaia 2013.

In terms of volume, Cos d’Estournel’s second wine Pagodes Cos 2012 (WA 88) was top. Last week, its older sibling Pagodes Cos 2011 (WA 88) took the honours. There has generally been strong activity on the Exchange for second wines, driven by Asian demand for popular brands at lower price points, boosted in recent weeks by the weaker Pound.

[mc4wp_form id=”18204″]