The St

Emilion 2012 Classification has thrust Pavie and Angelus into the spotlight

this week, with their upgrade to Premier Grand Cru Classe A generating good trading

activity for both. In the week following the announcement, Pavie has accounted

for an impressive 14.8% of all trades on Liv-ex, while Angelus closely follows

behind with 12.2% (Lafite Rothschild was third, with 11.9%).

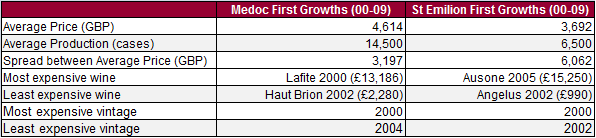

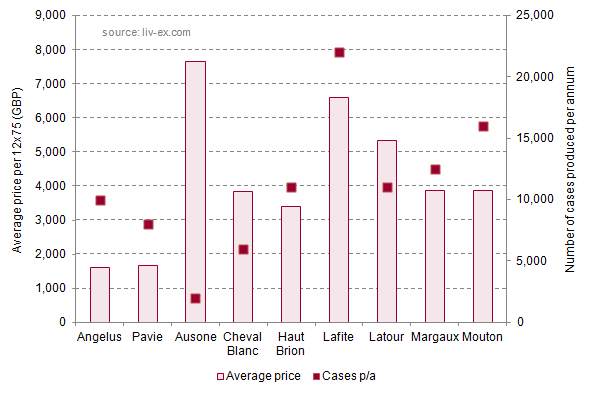

With four wines now categorised as Premier Grand Cru Classe

A, the St Emilion wines provide an interesting comparison to their five top

Left Bank counterparts, the Medoc First Growths. The chart below shows their average relative

Liv-ex trade prices per 12×75, for the 2000-2009 vintages. Although the

majority of First Growths are more expensive, the spread between the price

averages for St Emilion wine is greater than those of the Medoc. With the

average 12×75 of Angelus at £1,600 and the average of Ausone at £7,662, the

latter is almost four times more expensive than the former. Meanwhile, the

cheapest Left Bank wine, Haut Brion, is still more than half the price of the

most expensive, Lafite. The spread of averages within the categories would

suggest that Angelus and Pavie are currently priced below their potential.

The volume of wine produced each year for the Medoc First

Growths is also notably more than that of the St Emilion wines. Limited

production and scarcity leads to high prices for Ausone, which produces just

2,000 cases per year: just one fifth of the cases of Angelus.

Recent

trades in Pavie and Angelus suggest they have already benefitted – in the

short-term, at least – from the upgrade. Although a variety of vintages has

traded, newer wines are generating the most interest.The 2009s are outperforming

for both: Pavie’s perfect-scoring vintage (LWIN 1013850) accounted for 38.3% of its trades in

the last week (and 5.7% of total trades), while Angelus’ 2009 (LWIN 1006045) – scored 96 on

Wine Spectator – accounted for 75.4% of its own trades (and an impressive 9.2%

of total trades). With both more than half the price of any other of the 2009s for the wines above, and the majority of their vintages below the £1,500 mark per

12×75, their new status has certainly drawn buyers’ attention to their relative

value. Whether the interest continues beyond the immediate news frenzy will

tell how much these two brands stand to gain long-term from joining the top

ranks of St Emilion.