Fine wine was not immune to the global economic gloom in 2011. Prices fell rapidly in the second half of the year and the Liv-ex 100 Fine Wine Index declined 21.5 per cent. We noted in late 2010 that a price correction and a return to a more sustainable level of growth would be beneficial in the medium to long term. The severity and swiftness of the correction, however, took many by surprise.

Lessons learned

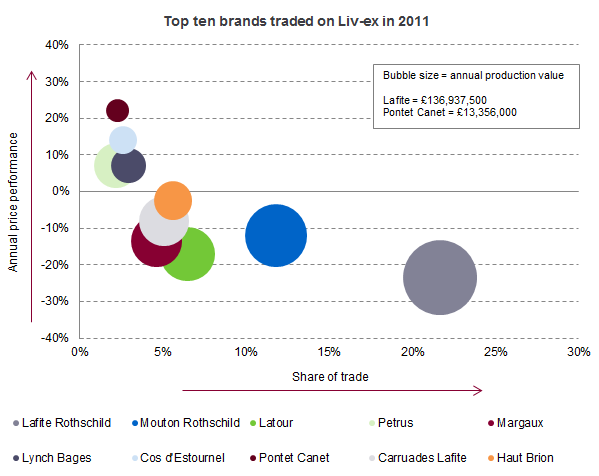

Many of these falls were concentrated in the First Growths, which did not relinquish their dominance over the market. This is demonstrated in the chart below, which shows the performance and production value (i.e. average price x production) of the top ten labels by value traded on the exchange in 2011. It wasn’t universally bad news as many of the second-line wines and Petrus managed to end the year slightly up.

With a weighting of 68 per cent in the Liv-ex Fine Wine 100 Index, the First Growths’ recent falls have clearly cast a long shadow on the market. And although the Super Seconds increased in value in the 12 months to December, their weighting is dwarfed by their higher-ranking cousins.

A stabilisation in the price of the Premiers Crus is a prerequisite to recovery in 2012. For this to happen, of course, they must reach a level where they regain buyer confidence and are once again seen to represent value. Encouragingly, we are seeing nascent signs that some wines are re-entering the ‘buy zone’. The Liv-ex Fine Wine 50 has edged upwards since the start of the year, while the Liv-ex Claret Chip inched higher in the first and second weeks of January for the first time since late July. More importantly, the value of bids on the exchange has started to rise again after falling for six consecutive months.

Positive triggers

Though the prevailing economic concerns continue to cast a heavy shadow, several scenarios could see the market find a floor in 2012.

An affordable 2011 campaign: The eurozone crisis and economic weakness could persuade the Bordelais to lower prices. If so, a well-priced en primeur campaign might reignite interest in Bordeaux, as it did in 2009 when the 2008 vintage was priced very fairly.

A return to value: The sharp price falls that were recorded in the second half of 2011 equate to those seen in 2008 after the collapse of Lehman Brothers. For this reason, one has to assume that a heavy dose of bad news is already in the price. Even a modest turnaround in sentiment towards the First Growths could have a profound impact on confidence.

High 2009 in-bottle scores: Robert Parker is expected to publish his in-bottle scores for the 2009 vintage in the next issue of the Wine Advocate. If his effusive Magic 20 tasting is anything to go by, the vintage’s scores may eclipse those of its forerunners, making it a ‘must have’ for collectors and strengthening interest in Bordeaux.

Easing of Chinese monetary policy: Over the last few years, China has been the driving force behind the market’s growth. As such, any moves to stimulate growth in China will certainly be cause for optimism.

As we sit here today, the fog of negativity that has shrouded the market since the summer is showing tentative signs of lifting. Indeed, as we discovered in 2009 and 2011, sentiment can turn remarkably quickly.