Although the market has yet to commit to a direction, there are several reasons to be cheerful this year. Demand has broadened in recent months and is no longer heavily concentrated in the First Growths. Perhaps as a result of this, a more diverse range of wines is now in play, including top labels from outside Bordeaux. The total value of stock bid and offered on the Liv-ex exchange is up 20 per cent year on year. The number of wines that have both bids and offers placed against them has risen 68 per cent in the last 12 months and the bid-offer spreads have tightened. Unsurprisingly, then, the volume of weekly transactions is up 20 per cent year on year. With First Growth trade reduced, however, trade by value is down 15 per cent.

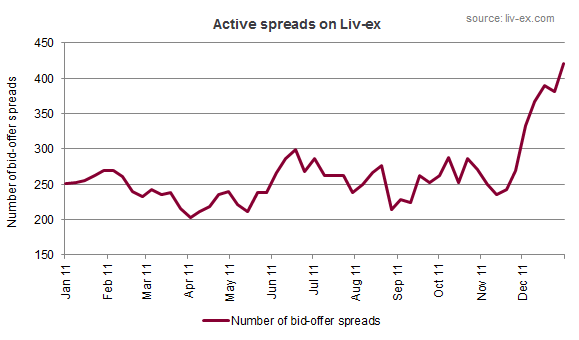

The rise in the number of active spreads on Liv-ex is shown in the chart below.

Is the improved breadth and depth of the market encouraging more merchants to trade? Despite Chinese New Year celebrations, merchant engagement is at its highest level since September.