Despite widespread predictions at the start of the year that the First Growth bull run was drawing to a close, the Liv-ex Fine Wine 50 moved into 2011 in buoyant fashion. Prices continued to rise until the 28th of June, by which time the index was up 11 per cent for the year. From then on, price falls that could at first be dismissed as a blip turned into a correction and then an increasingly angry bear. By the end of November 2011, the index had fallen by 12 per cent year to date, representing a 23 per cent fall since peak.

But how low is too low? At what point do the Firsts become a buy once again for UK-based fine wine enthusiasts – as opposed to pure investors or global HNWIs? We spoke to our trading members and found that the £250-300 per bottle price range was where interest starts to rise amongst their private clients. A price similar to the cost of a night in a mid-range London hotel or a weekend away in the country – affordable to the majority of those that have a keen interest in fine wine.

If we take the 55 First Growths from vintages 1995-2006 (excluding 1997) we find that in June 2011 only three of these wines had a price of below £300 per bottle in-bond. By the end of November this group had grown to 24. All of the Firsts, bar Lafite, are represented in this group, with the wines spread across nine different vintages – only 2000 and 2005 are excluded.

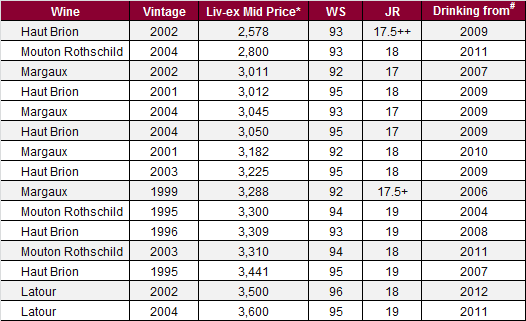

Also significant is that bar a couple of the 2006s, all of the wines are now into, or about to hit, their drinking windows. When coupled with more affordable pricing this would suggest that consumption will increase and supply start to diminish – potentially putting a break on price falls and reducing downside risk. Seven of these wines also boast a Wine Spectator score of 95 points and above, while 11 are scored at 18 or above by Jancis Robinson. If we exclude wines not yet in their drinking windows or carrying scores of less than 92, we are left with 15 wines. These are listed below.

*Liv-ex Mid Price (£) per 12x75cl case in good condition stored in bond. / # Earliest drink date from a major critic.

The one wine notable by its absence is Lafite. Despite its dramatic price falls of recent months, the cheapest Lafites (2001, 2002, 2004 and 2006) are still trading at around £6,500. For Lafite to fall back into this ‘buy-zone” would require further price declines of 45 per cent. As such, its fate remains largely dependent upon Asia.

If we look back to the 2008 correction, which had a similar trajectory to the current one, the low point of the market – and hence the best time to buy – proved to be December 2008.

Scores from Winespectator.com and Jancisrobinson.com.