After retracing its steps on Monday, the Liv-ex Fine Wine 50 Index edged up 0.22 points yesterday to 345.94. Although the index is not yet wedded to either direction, it would seem that the uncertainty that has weighed on the market since June may at last be subsiding.

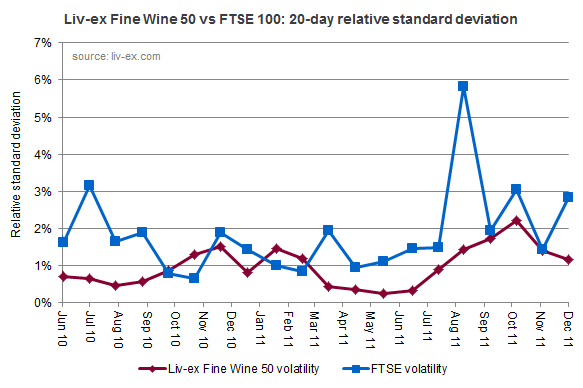

The chart below shows the Liv-ex Fine Wine 50's volatility since June 2010, alongside that of the FTSE 100, and is based on the relative standard deviation from the 20-day mean*. As you can see, the Fine Wine 50's standard deviation fluctuated between 0.26 per cent and 1.48 per cent during the first half of this year. In October, however, heightened uncertainty saw 20-day volatility rise above two per cent for the first time (although it remained significantly lower than that of the FTSE).

In recent weeks, prices have become more stable and the current level of volatility is now comfortably within the range seen in previous periods. So what does this tell us? Some market commentators argue that there is a strong correlation between volatility and performance, and volatility tends to decline as markets rise. At the very least, the dramatic price falls of late autumn appear to be abating.

*Relative standard deviation is used to compare the volatility of samples with different means. All volatility calculations are based on the relative standard deviation of 20 trading days, excluding weekends.