Last month, the Liv-ex Fine Wine 100 Index fell 4.5 per cent, representing a 15.5 per cent decline from its peak. Despite these gloomy numbers, there are many reasons to remain optimistic. The market fundamentals are still intact, while the main driver of demand, China, remains in growth. When in the midst of a correction of this size, it is natural to act defensively. Yet, with the price falls starting to slow considerably (almost all of this month’s falls occurred in the first 20 days of the month), are we now approaching an attractive entry point?

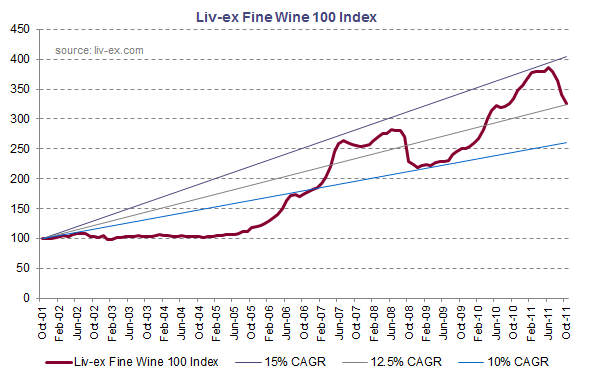

Studies of fine wine prices looking back 50 years have shown that, on average, fine wine has returned 12.5 per cent per annum. On this basis, the chart below shows that we are now nearing this long-run average on a ten-year basis. The correction of 2008 did overshoot this level, yet anyone who bought in the last three months of 2008 was sitting on handsome profits just 12 months later.

As we outlined in the September Market Report, we suspect that the next bull run in wine is unlikely to be led by Lafite. Indeed, as the Chinese market becomes more sophisticated, it seems inevitable that it will experiment with a broader range of wines. In August, we outlined how DRC was significantly outperforming the market. But despite its recent success, its inherent liquidity issues suggest that the wines of Bordeaux are far more likely to lead the recovery.

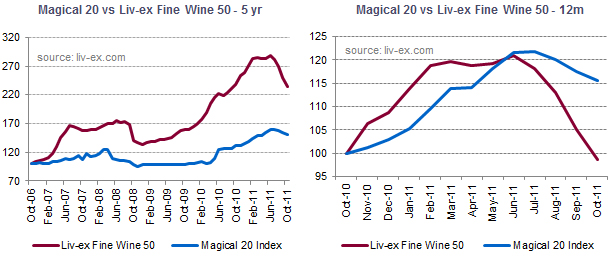

This week, Robert Parker is leading a tasting of top Bordeaux in Hong Kong, which he has dubbed “The Magical 20”. In his own words: “I have chosen estates that produce wines of ‘First Growth quality’ although technically not First Growths…and because of that are under-valued and very smart acquisitions."

Many of these so-called Magical 20 wines—such as Leoville Las Cases, Lynch Bages and Pontet Canet—have seen a significant uptick in demand in 2011 and it is possible that this trend could continue.

Here we have created an index of the these 20 wines and compared their performance to the Liv-ex Fine Wine 50, which is exclusively composed of First Growths. As you can see, the Fine Wine 50 has vastly outperformed the Magical 20 over a five-year period. This gap has narrowed recently, however, with the Magical 20 outperforming the Fine Wine 50 over the last 12 months. Given that the Magical 20 wines trade at an average 85 per cent discount to the First Growths (some £800 a case as opposed to £5,300), Parker seems to be right in suggesting that there is plenty of relative value in these wines. A narrowing of the discount to say 70 per cent could see these wines double in price.