Since the start of 2011, a surge in demand for the Super Seconds has propelled prices to new heights. Among the beneficiaries is Leoville Las Cases, which was classified as a Second Growth in 1855 but is often referred to as the "sixth First Growth". Since December, the chateau's last ten physical vintages have risen in value by an average of 23 per cent, with the 2002, 2003 and 2008 all gaining more than 30 per cent each. But although Las Cases has upped the ante this year, corresponding vintages of the First Growths are trading at more than four times the price.

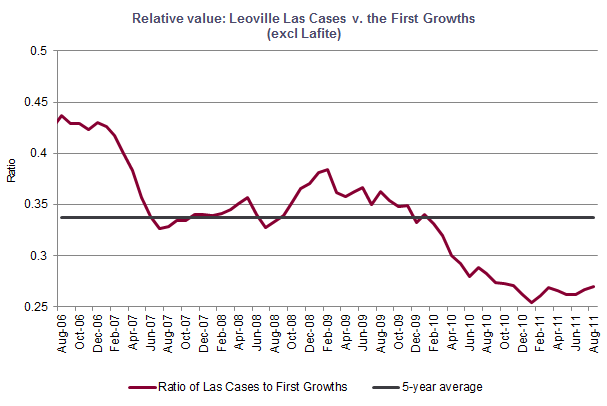

Even if we take Lafite out of the equation, the current value of the First Growths continues to dwarf that of Las Cases. On average, physical vintages of the latter are just 27 per cent of the price - down from 29 per cent in May 2010 and upwards of 50 per cent in early 2004. This decrease in relative value (rather than price) is a clear indication of the Second Growth's strong potential value, particularly given its recent run.

The chart below shows the historical relationship between Las Cases and the First Growths. The ratio of Las Cases to the Firsts (excluding Lafite) was 0.56 in April 2004. In recent years, however, it has drifted from 0.44 (in 2006) to an all-time low of 0.25 in January 2011. Nonetheless, flagging demand for the Firsts has pushed Las Cases' relative value higher this year. Does this suggest that there is a strong case for investing in the brand now, while the ratio remains some way off its historical average (0.34)?