Download this article as a pdf

The prices achieved by the top wines from Bordeaux have soared in recent years on the back of sustained global demand. The Liv-ex Fine Wine Investables Index, which tracks more than 200 of the top red wines from across the region, has increased by more than 170 per cent in the last five years alone. So – with their products achieving hitherto unprecedented prices – what price would the top Bordeaux properties sell for?

Without access to the financial accounts of the individual chateaux, producing a valuation using the standard methodology applied to a business (a multiple of profits) is near impossible. As such, Liv-ex looked at other possible ways that a valuation of the major players could be achieved.

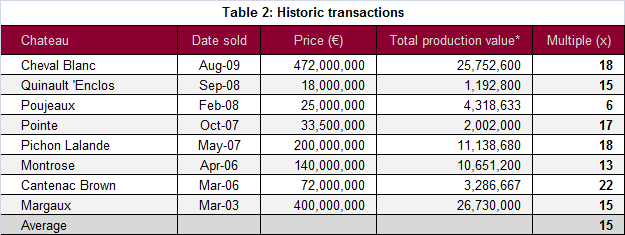

The most transparent and accurate data available on Bordeaux wines is their secondary market trading price. As such, we decided to base our valuations on this data. The value of each chateau’s annual production (i.e. average trading price multiplied by quantity made) was used as our core data point. We then looked back to find out what relationship this figure has had with the actual transaction prices of major chateaux in recent years. (See “How we did it” for the full methodology.) Interestingly, we found a remarkably consistent relationship between the two figures. On average, top chateaux have exchanged hands at 15 times our measurement of production value.

This relationship was then combined with current market pricing to calculate the value of the leading Bordeaux chateaux.

All those estates valued at more than €50 million (a figure that just over 50 estates managed to surpass) are outlined in the accompanying data table (Table 1).

Average Case Price: Average market price for the 2005-2009 vintages in the 12x75cl unit size. This number was adjusted (divided by 1.5) before the final calculation was made to adjust for merchant and negociant margins.

The power of Bordeaux

With a combined market value of more than €15 billion, the top Bordeaux chateaux are now clearly powerful luxury brands in their own right. Indeed, the raw data behind these calculations is somewhat staggering: more than 12.5 million bottles of wine are produced by just the top 50 estates, with a combined market value in excess of €1.6 billion.

It comes as no surprise that the First Growths fill the top five places, with all but Haut Brion valued at more than €1 billion. The top “Super Seconds” come in at €200 to €500 million, as do Pontet Canet, Duhart Milon and Lynch Bages. Over on the Right Bank the most valuable estate is, unsurprisingly, Petrus. At an average price of €20,000, it also has the highest case price in the study. The top ranking St Emilion is Cheval Blanc. Although at €435 million, it is eight times less valuable than Lafite.

The estate on the list with the lowest total production is Le Pin. Despite only producing around 600 cases per year, it has an estimated valuation of €90 million, thanks to its €15,000 average case price. In contrast, Prieure Lichine has an average price of just €275 per 12x75cl case, but its 27,000 case production means it comfortably makes the €50 million club.

Profits and prestige

The fact a Fourth Growth such as Talbot can achieve a valuation in excess of €150 million may strike some as excessive. However, it must be remembered that top Cru Classe Bordeaux estates have an estimated gross margin of between 70-99 per cent. As such, the multiplier we have used represents a valuation of around 16-20 times pre-tax earnings. This would still be considered a punchy valuation in almost any other market, but when you consider the current rate of increase of fine wine prices, this can be justified. The other factor to consider is that the top chateaux are truly ‘trophy’ assets and rarely come onto the market. Their perceived value, therefore, is greater than would be surmised from a purely profit-based approach.

Left versus Right

Twenty-two of the top 25 estates are from the Left Bank, with Petrus, Cheval Blanc and Ausone the sole interlopers from the Right. The key to achieving a high valuation was to have a large production and a strong second wine, neither of which is common in Pomerol or St Emilion. It is becoming increasingly clear that for the top names of the Right Bank to compete effectively with their peers across the river they need to be able to expand their production, as is common in the Medoc. This is currently not possible under regulations governing the St Emilion Grand Cru Classe. The proposed reforms, which would allow estates to expand (although still in a far more limited way than is possible in the Medoc), clearly can’t come soon enough for the likes of Cheval Blanc and Angelus.

Lafite Rothschild – a four billion euro estate?

The one valuation that looks particularly challenging to accept is that of Lafite Rothschild, which tops the rankings. At a price of almost four billion euros, Lafite is almost certainly the most valuable wine brand in the world, valued on a par with multinational drinks conglomerate Constellation Brands. If we look at the numbers used in the calculation, the reasoning behind its sky-high valuation is clear. Lafite is now producing wine with a market value of close to €400 million – every single year. Even when taking into account the margins taken by merchants and negociants, Lafite could presumably sell its production for more than €250 million, if it exploited the current market price of its wine to the maximum extent possible. (As an aside, the fact that it currently doesn’t and leaves a significant amount of margin on the table for its distribution partners could be a major reason for its runaway success.)

The other factor to consider is that at a valuation of €3.7 billion, only a multinational company would be able to buy it outright. As such, it could be argued that a lower multiple of production value should be used, as multinational companies are not known for making vanity investments. Nevertheless, even if Lafite’s value on the open market would achieve somewhat less than we have stated here, it would undoubtedly attract a multi-billion euro price tag. Indeed, the production of its second wine, Carruades de Lafite, generates more revenue than legendary estates such as Haut Brion or Petrus.

Notes:

Errors and omissions – a word of caution

Any piece of research is only as good as the data used. The key issue we faced when compiling this research was obtaining accurate production numbers. We used both the official declarations lodged with the local town halls and other publicly available information to calculate our estimates. We also, on occasion, asked the chateaux themselves. There is obviously a significant margin for error here.

Furthermore, the top Bordeaux chateaux are traded very infrequently and both buyer and seller are usually private companies. As such, getting hold of the actual transaction prices is similarly difficult.

Other influences on the price of the chateaux, such as the chateau buildings themselves; additional land available for planting; recent capital investment; library stocks; cash held and debts, were not taken into account. We have also ignored the value of third wines and wine sold off in bulk.

We have assumed a standard merchant and negociant margin across all chateaux.

As such, this research is best treated as a first step to determining a new valuation methodology for the leading chateaux. Real-world results might deviate significantly from the values provided.

How we did it

- First we calculated the current trading price in euros of a 12x75cl case from the five most recent vintages (2005-2009) of both the first and second wines (where applicable) from each Bordeaux estate. We then averaged this to provide us with a case price.

- This case price was multiplied by the amount of cases produced, on average, by each estate, each vintage (culled from the declarations de recolte and other publically available sources).This provided the total market value of each estates annual production.

- This total value was then modified (divided by 1.5) to account for the margin taken by the negociants and wine merchants. This provided the total income achievable, by the chateau for one vintage release.

- We then looked at major transactions of Bordeaux estates where the transaction price was relatively transparent or widely reported. This figure was divided by the value of that chateau’s production (worked out in the same way as above) at the time of the sale. The average multiple across all the wines we looked at was 15. (See table 2)

- We then multiplied the total income achievable (Step 3) by 15 to calculate the current value of each chateau. (See table 1)

*Total production value based on average price at time of sale, multiplied by production.