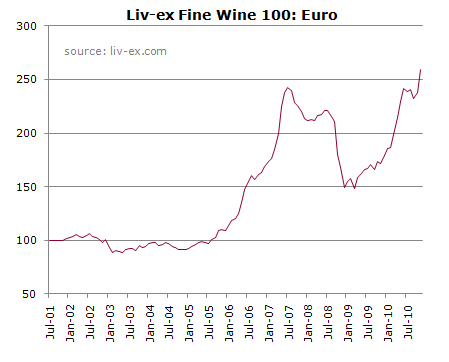

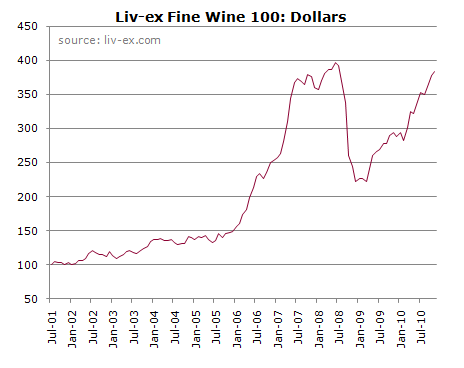

Fine wine prices put in a dramatic increase in 2010 – with the benchmark Liv-ex Fine Wine 100 up more than 40% in just twelve months. Understandably, these rapidly rising prices have stoked fears that the top-end of the market is approaching bubble territory. If we convert the sterling-based Liv-ex 100 into other global currencies, however, a somewhat different picture emerges.

An international perspective

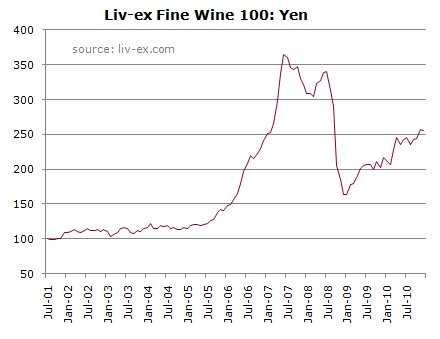

When based in euros, the index only moved past the level set in July 2007 in October 2010. In dollars the index remains five points (or 1.2%) off its high, reached in June 2008. If we look at Yen – the results are even more dramatic. The index remains 29.7% off its all time high. In Japan, we are still a long way from a bubble.

So what is the situation in the current diver of global demand, China? When based in the dollar-linked Renminbi, the index sits 10% below its June 2008 high. For the Chinese buyer, fine wine prices are still someway below their historical highs. It is only Lafite Rothschild and a handful of other brands (such as Duhart Milon and the First Growths’ second wines) that have far surpassed their pre-2009 pricing.

Sterling troubles

Of course, the majority of the data used to calculate the Liv-ex Fine Wine Index is in pounds and euros (as you would expect, with London and Bordeaux remaining the leading trading hubs for trade buyers). This suggests these results should be treated as indicative rather than definitive. But it does show that the rapid increases we have seen in London pricing is partly due to currency movements – or more precisely the depreciation of the sterling since 2007. With the Bank of England continuing to press forward with its quantitative easing plan, this is a situation unlikely to change in the medium term.

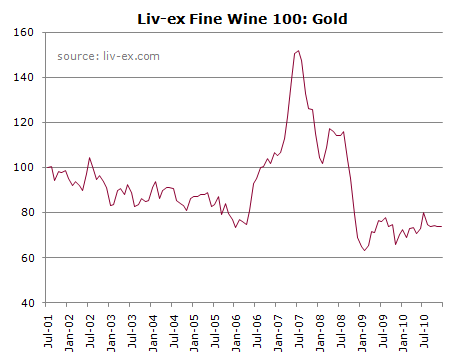

This can be clearly seen if we base the index in gold, the classic store of government wealth. With gold prices having almost kept pace with wine prices in recent years (even when measured in sterling), the trend since the tumultuous economic events in the latter half of 2008 has been broadly flat. In essence, fine wine has started to behave as a store of value. Perhaps Sauternes is not the only fine wine that should be described as liquid gold.